Millennials are not messing around when it comes to their money these days. Some have seen one or even both parents lose a job or at least know someone who has been affected by a similar situation. Combine that with the pressure of a not-so-great job market, and many young professionals feel the heat that they could be replaced at a moment’s notice.

So what’s a hardworking millennial to do? Spend less, save more, and become a cheapskate.

While the image of an unhappy toddler kicking and screaming may come to mind as you tell a young professional that they can’t spend as much, just the opposite is happening. According to Bloomberg Business, “The millennials who are really on a roll….saved at least 5 percent of their income [which] increased to 56 percent from 50 percent in 2014.”

And with sites like LearnVest, Mint and MoneyUnder30, millennials have more access than ever to learn about how to spend their money and how to save it. They’re using technology to their advantage and clipping coupons and shopping digital weekly ads prior to going to the grocery store.

By mixing money saving apps and extreme couponing blogs at their fingertips, millennials are able to save more of their tiny incomes and prepare for any unexpected changes in the market.

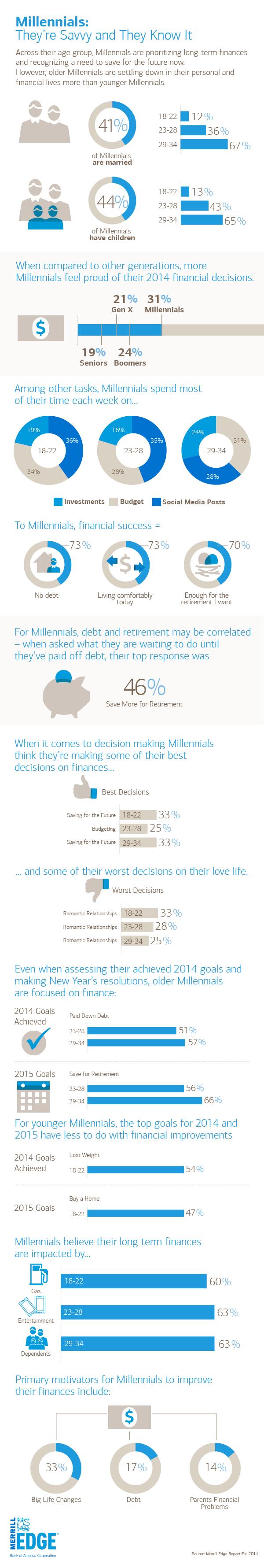

If there’s one thing that millennials are doing right it’s the fact that they know how to budget, spend and save their money. Don’t believe TMD? Check out this infographic by MerrillEdge.com:

Featured Photo Credit: USNews.com